On this version

- Maryland reopens COVID-19 enrollment window, extends it till Dec. 15

- Most of Pennsylvania’s medical insurance market insurers suggest fee decreases for 2022

- Kentucky insurers suggest common fee improve of 11 % for 2022

- New insurers provide plans in North Carolina market for 2022

- New Mexico CO-OP will shut on the finish of 2022, leaving simply three CO-OPs in U.S.

- HHS approves New Hampshire reinsurance program

- Nebraskans submit practically 2,700 functions in first six days of Medicaid enlargement enrollment

- Twenty attorneys normal categorical opposition to permitting healthcare sharing ministry bills to be tax-deductible

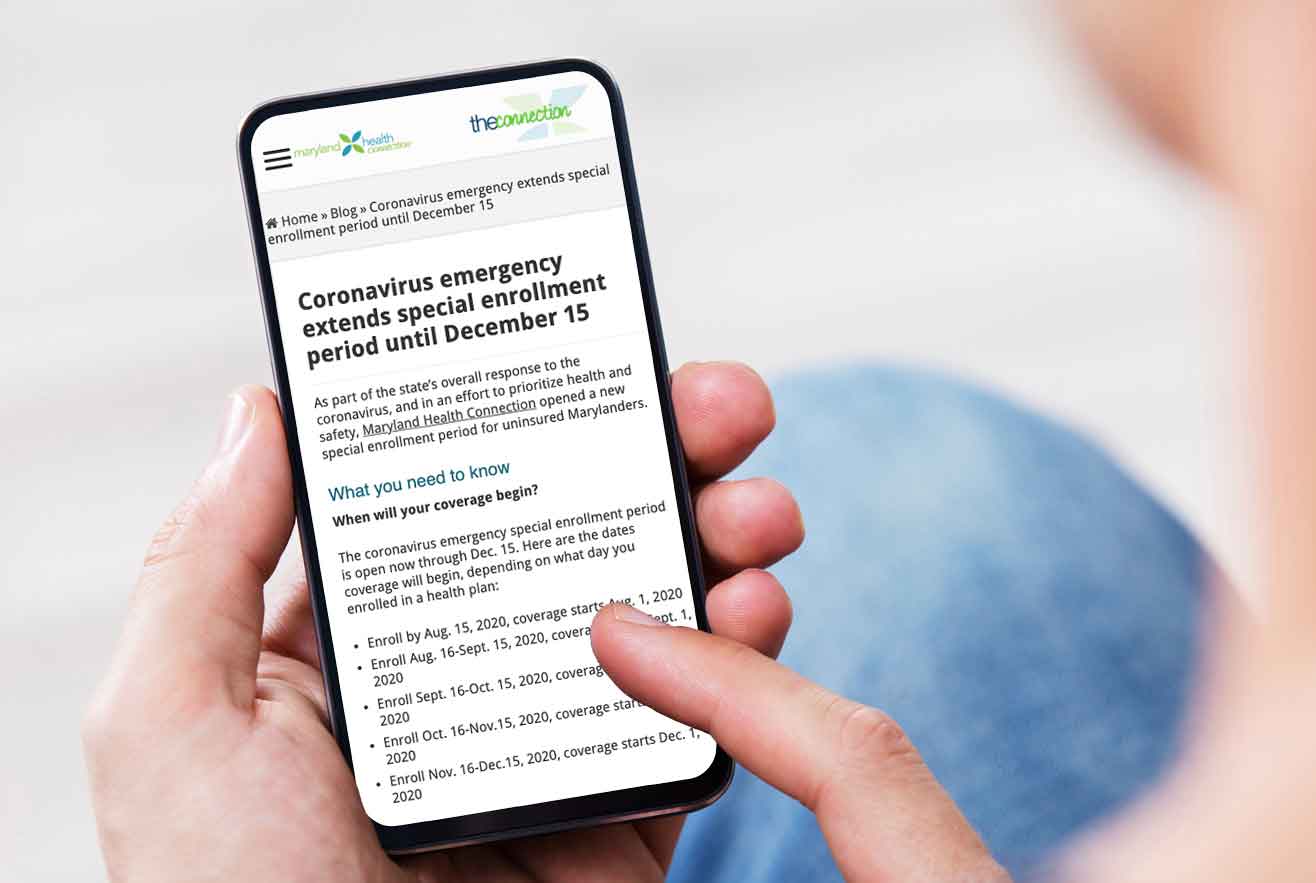

Maryland reopens COVID-19 enrollment window, extends it till Dec. 15

Like a lot of the different state-run exchanges, Maryland Well being Connection opened an enrollment window this spring to deal with the COVID-19 pandemic, permitting uninsured residents to join medical insurance, even when they didn’t have a qualifying occasion. Greater than 54,000 individuals had signed up by mid-July, when the window ended. However final week, Maryland Well being Connection reopened the particular enrollment interval and introduced that it’ll proceed till December 15. The extension by mid-December will permit uninsured individuals the choice of enrolling with practically rapid (and even retroactive) protection – even throughout open enrollment this fall. (Individuals who use the traditional open enrollment window could have protection efficient January 1, 2022; the COVID-19 particular enrollment interval will permit uninsured Marylanders to get protection with out having to attend till January.)

COVID-19 particular enrollment intervals are nonetheless underway in New York, Vermont, California, and Washington, DC, though Vermont’s ends on Friday and New York’s ends on Saturday (assuming no extra extensions). The federal authorities opted to not provide a COVID-19 particular enrollment interval for HealthCare.gov, which is utilized by residents in 38 states. Democratic lawmakers have lengthy decried that call, and proceed to induce the Trump administration to rethink. Final week, 25 Democratic Senators despatched a letter to the president, asking him to open an enrollment interval on HealthCare.gov to permit uninsured residents a possibility to get well being protection for the rest of 2022.

Most of Pennsylvania’s medical insurance market insurers suggest fee decreases for 2022

Pennsylvania’s individual-market insurers have proposed a weighted common fee lower of about 2.6 % for 2022. With out Pennsylvania’s newly authorized reinsurance program – which is able to take impact in 2022 – the general proposed fee modifications would possible have amounted to a small improve over 2022 charges, however the reinsurance program is preserving premiums in verify.

Highmark Selection Firm – one in all a number of Highmark associates in Pennsylvania – is discontinuing all of its present plans (that are bought each on- and off-exchange) and can provide only a single Bronze plan outdoors the alternate for 2022. Highmark Selection Firm’s enrollment accounts for lower than 1 % of Pennsylvania’s particular person market.

Kentucky’s individual-market insurers suggest common fee improve of greater than 11 % for 2022

Kentucky’s two individual-market insurers have proposed common fee will increase of 16.6 % and 5.3 %. The weighted common proposed fee improve quantities to about 11 %. That is far larger than the nationwide common to this point: throughout 20 states the place individual-market fee submitting information have been made public, the weighted-average proposed premiums improve for 2022 is 1.85 %. Solely New York has the next total common proposed fee improve than Kentucky.

New insurers provide plans in North Carolina market for 2022

In step with the development that we’re seeing in quite a few states throughout the nation, North Carolina’s medical insurance market will achieve some new insurers in 2022. Oscar will be part of the alternate within the Asheville space. UnitedHealthcare will rejoin the alternate, after exiting on the finish of 2021, and it seems that Sentara/Optima – which at the moment affords individual-market protection in Virginia – can even be part of North Carolina’s alternate for 2022.

Throughout the present insurers in North Carolina’s medical insurance alternate, proposed fee modifications for 2022 vary from a lower of about 14 % for Cigna, to a rise of about 6 % for Ambetter.

New Mexico CO-OP will shut on the finish of 2022, leaving simply three CO-OPs in U.S.

Simply 4 of the unique 23 CO-OPs that had been created below the ACA are nonetheless operational this 12 months, and that may drop to 3 as of 2022. New Mexico Well being Connections introduced this week that it’ll shut on the finish of 2022; its 14,000 members might want to choose new protection in the course of the open enrollment window that begins November 1, 2022.

The New Mexico Workplace of the Superintendent of Insurance coverage has printed FAQs in regards to the CO-OP closure, clarifying that members don’t have to do something now, and could have a possibility to select a brand new plan throughout open enrollment (November 1 – December 15). Members who’ve their protection by the New Mexico market (HealthCare.gov) will likely be mechanically enrolled in a comparable plan from one other insurer in the event that they don’t choose their very own new plan throughout open enrollment.

Earlier this summer time, New Mexico Well being Connections had proposed by far the most important proportion fee improve in New Mexico’s particular person marketplace for 2022. The remaining three insurers proposed far more modest fee modifications. And two new insurers – Western Sky Group Care (Ambetter/Centene) and Friday Well being Plans – will be part of New Mexico’s alternate for 2022, with plans obtainable for buy beginning in November. So though New Mexico’s CO-OP is closing, the state will go from having 4 collaborating alternate insurers to 5.

HHS approves New Hampshire reinsurance program

Final week, HHS authorized New Hampshire’s 1332 waiver proposal for a reinsurance program. The state expects full-price individual-market premiums to be about 16 % decrease with the reinsurance program than they might in any other case have been, and initiatives that complete particular person market enrollment will develop by about 6 % with the reinsurance program in place.

New Hampshire’s reinsurance program will likely be funded with a premium evaluation on well being insurers in New Hampshire, in addition to federal pass-through funding. (The federal authorities will spend much less on premium subsidies because of the decrease total premiums, and New Hampshire will get to make use of the financial savings to fund its reinsurance program.)

Final month, HHS authorized Pennsylvania’s reinsurance proposal. As of 2022, New Hampshire and Pennsylvania will be part of a dozen different states the place energetic reinsurance packages are preserving individual-market medical insurance premiums decrease than they might in any other case be, and offering normal stability to the markets.

Nebraskans submit practically 2,700 functions in first six days of Medicaid enlargement enrollment

Nebraska’s Medicaid enlargement protection takes impact in October, practically two years after voters within the state handed a Medicaid enlargement poll measure. Enrollment started on August 1, and within the first six days, 2,692 functions had been submitted. Nebraska initially projected that 90,000 individuals would achieve eligibility for protection below Medicaid enlargement, however a Households USA evaluation decided that a further 33,000 individuals may be eligible because of the widespread job losses brought on by the COVID-19 pandemic.

Twenty attorneys normal categorical opposition to permitting healthcare sharing ministry bills to be tax-deductible

In June, the IRS issued proposed laws that will permit healthcare sharing ministry bills and direct major care bills to be tax-deductible medical bills for filers who itemize their deductions, and permit employers to reimburse these membership charges utilizing well being reimbursement preparations. This week, attorneys normal from 20 states – led by California Legal professional Normal Xavier Becerra – despatched a letter to the IRS, expressing opposition to the proposed rule and asking that or not it’s withdrawn.

The attorneys normal be aware that the proposed rule will improve client confusion, making it more durable for individuals to appreciate that healthcare sharing ministry plans will not be actual medical insurance and shouldn’t be thought of an enough substitute for main medical protection. In addition they level out that the rule would additional section the market, with wholesome individuals more and more choosing non-insurance protection, whereas sick individuals stay within the ACA-compliant market. The letter additionally prices that the proposed rule is bigoted and capricious, and goes past the authority that the IRS has.